Mitigate risk and non-compliance at every port call

DA-Desk enables you to automate and streamline due diligence, mitigate the risk of fraud and provide evidence of regulatory compliance

Every port call is screened, including every appointment, every proforma disbursement account (PDA), and every final disbursement account (FDA).

DA-Desk is supported by a 60+ team of compliance researchers, analysts and sanctions specialists monitoring global trading and regulatory developments 24/7 to support our customers

Our customers rely on us for compliance

Ardmore Shipping has been a DA-Desk customer for more than 5 years. Apart from the efficiency and savings, safety checks, and VMS integration, compliance is an important part for them. Read the story >>>

The compliance element is a major benefit to us. Presently, compliance is crucial, and we rely completely on DA-Desk’s scalability to conduct the required checks and action related notifications as needed. It’s very helpful.

Robert Gaina, Director of Commercial Operations, Ardmore Shipping

“DA-Desk is very good at ensuring that we remain compliant with sanctions and how we remit funds.”

Dorte Christensen, Vice President Operations & Claims, Hafnia

“The AFC checks done in DA-Desk are an important comfort for us – it is not something we could do on our own. DA-Desk has the resources to mitigate the risk for us.”

Oskar Fabricius, CFO, Ultrabulk

“It’s important to have a company like DA-Desk who have the structures in place to assist users with compliance.”

Giuseppe Oliveri, Fleet Manager at d’Amico Group

Trade & economic sanctions compliance

Using data from multiple providers such as Dow Jones and Accuity, DA-Desk carries out screening and checks against:

- Global sanctions lists which include OFAC, EU, US, UN, and other country-specific lists

- Specially designated nationals (SDN) and non-SDN lists

- Other official lists such as INTERPOL, state-owned entities, tax defaulters, amongst other lists

Know Your Counterparty (KYC) checks

- Obtain KYC data and perform due diligence on your agents, vendors and suppliers

- Cleanse and enhance the KYC data including:

- Establishing if the name is a trading name or legal registered name

- Perform verification of the address and contact details

- Obtain and screen ultimate beneficial owner (UBO) information

- Obtain source of funds information

Bank account verification

- Continuous screening of beneficiary names and banks with IBAN / SWIFT validation

- Perform enhanced due diligence if receive a request to make a payment to a jurisdiction different from that of the relevant counterparty

Information security

In the past few years, we have prevented over a hundred fraudulent and phishing attempts, saving our customers and agents over $5 million that would otherwise have been lost to fraud.

Download our latest report:

How to reduce your maritime anti-financial crime compliance risks

Sanctions in the maritime industry are being imposed faster than ever before, and the high-pressured regulatory landscape means not only has your liability changed, but the anti-bribery and anti-money laundering compliance landscape is becoming increasingly complex.

Inside, you’ll discover:

- How the maritime landscape of anti-financial crime compliance is changing

- How Operations Directors can reduce anti-financial crime compliance risks

- Survey results – how Operations Directors view AFC challenges

Payment approval and transaction monitoring

- Pre-payment and post-payment checking to help ensure that payment is processed successfully – if not, we get involved to resolve it

- Running screening checks again on the bank and the beneficiaries of the payment, seconds before payments are released to our banking provider

[rd_images_gallery images=”1677″]

Sarbanes-Oxley (SOX) Act compliance

We are audited (Deloitte’s annual ISAE 3402 Type II audit), to complement and support your SOX compliance requirements:

- DA-Desk controls are appropriately designed, tested, and implemented, thus complementing the customer’s audit requirements

- Full record trail, books and records compliance. The DA-Desk platform allows for the uploading, collation, review, and retention of all supporting port call-related documentation

Invoice and DA validation by DA Validation Engine (DAVE)

DA-Desk checks DAs and invoices for irregularities and inconsistencies in the value of those invoices – we do this combining our specialists and automation. DA-Desk’s proprietary system which does this is named as DA Validation Engine (DAVE).

Issues that arise are resolved directly by the DA-Desk team, providing you with two benefits:

- direct cost savings

- an added check on the legitimacy of invoices for fraud prevention, AML and ABC

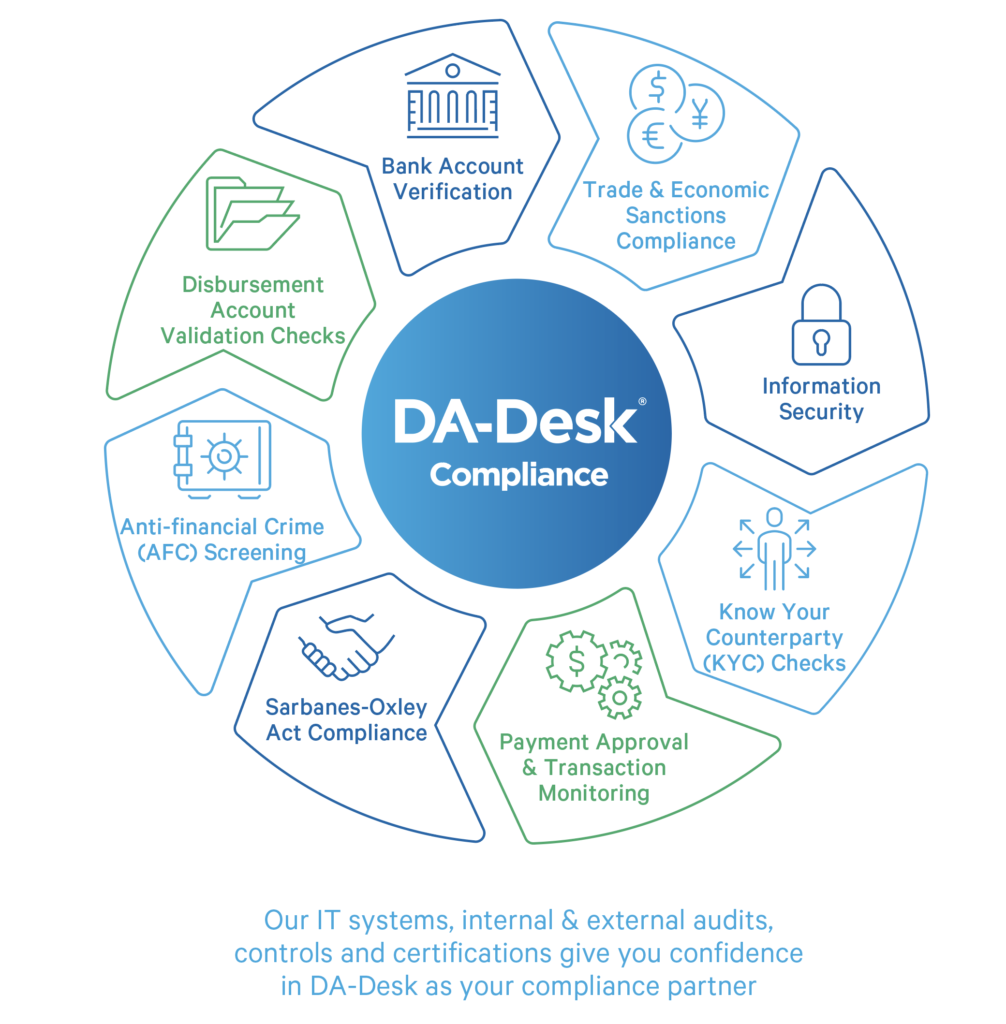

DA-Desk assurance

Our IT systems, internal & external audits, controls and certifications give you confidence in DA-Desk as your compliance partner

Our processes and controls are certified and compliant with:

- ISO 9001 Quality Management System

- ISO 27001 Information Security Management System

- ISO 14001 Health, Safety & Environment Management System

- ISO 45001 Occupational Health & Safety Management System

- GDPR – General Data Protection Regulation

- ISAE 3402 Type 2 Report – Annual Service Auditor’s Report